Power trade

Skagerak Kraft’s normal production is around 5.7 TWh per year. A major proportion of this production is traded in the spot market. We also supply power in Statnett’s reserve markets and trade in the bilateral market Nordpool Intraday.

Renewable hydroelectric power production

Skagerak Kraft’s power production is in spot price areas NO1, NO2 and NO5. We report our available power production in the spot market every day throughout the year. This output is distributed between our various power stations and generators, which all have particular costs relating to power production. The cost of production is called water value and expresses the minimum price required to decide to use the water for production now or later.

Calculating water value

We use advanced models to optimise our production based on inflow, reservoir filling and electricity demand. Factors with a bearing on the water value include reservoir filling related to individual power plants, efficiency per generator, start/stop costs, and inflow and short-term and long-term price forecasts. The models use advanced algorithms to deal with uncertainty and the relationship between inflow and price.

Both inflow and price are stochastic variables in the short and long term and represent a significant uncertainty when calculating the water value for individual power plants. Inflow is dependent on precipitation, temperature and the amount of snow. The market power price depends on inflow, reservoir filling, consumption, costs and the capacity for thermal power production, wind, sun and transmission capacity in the grid. Inflow forecasts and market descriptions are used as input in our own optimisation models.

The spot marked

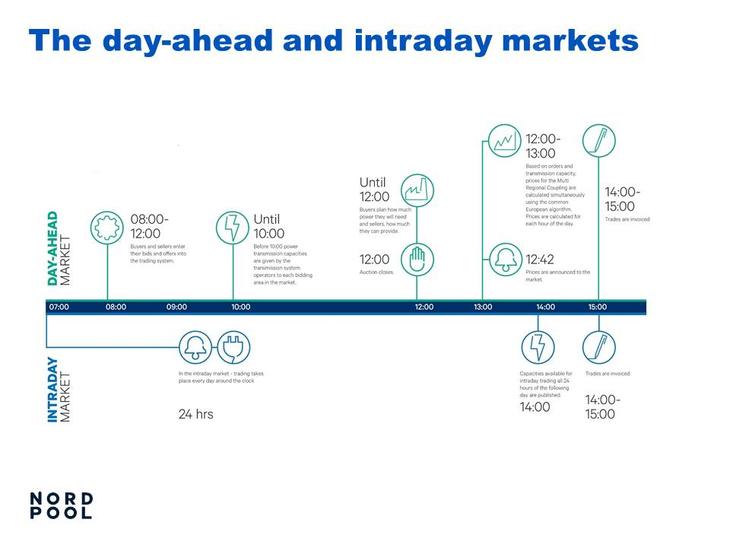

Skagerak Kraft uses NordPool’s power exchange to sell much of its power production. This is where sellers and buyers enter into agreements on price and volume for the sale of power for the coming day. NordPool states that there are currently about 360 buyers and sellers on the ‘day-ahead market’ and that there are around 2,000 buy and sell orders every day. NordPool has a fixed trade pattern, and 12.00 is the deadline for submitting bids for buying and selling each day. Shortly after the deadline, the purchase and sale agreements for the coming day are in place.